Understanding Rising Insurance Costs and Their Impact

Healthcare in the US is complex. But one question continues to perplex both individuals and families alike: why does the cost of health insurance keep increasing at such an alarming rate? It seems that each year, insurance premiums take a larger bite out of our wallets, leaving us wondering about the driving forces behind this relentless rise.

The Context

In truth, Americans have endured an average 43% increase in just their insurance premiums alone over the last decade. This translates to an average annual expenditure of $7,911 for an individual and $22,463 for a family. That comes out to monthly expenses of $659.25 for an individual and $1,871.92 for a family. Considering the median salary in the united states is just over $45,000, an individual is spending nearly 18% of their income on their health insurance. The median household income in the US is $74,580, and so the average family is spending 30% of their income on insurance premiums.

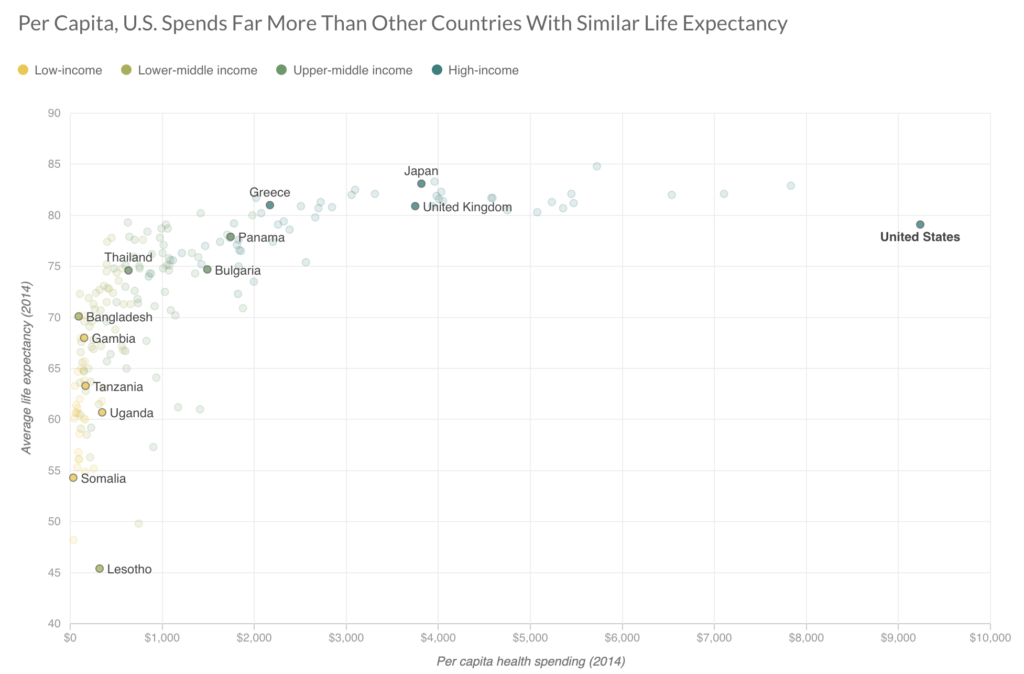

The US spends more per person on healthcare than any other industrialized country. Source: Institute for Health Metrics and Evaluation, World Bank country classifications

The US spends more per person on healthcare than any other industrialized country. Source: Institute for Health Metrics and Evaluation, World Bank country classifications

So what’s happening here? Why are rates going up SO MUCH?

Medical Inflation and Technological Advancements:

One of the primary culprits behind the escalating cost of health insurance is medical inflation. As technology advances and new treatments emerge, the expenses associated with healthcare also surge. It’s true that monitoring blood sugar with a Dexcom provides a much richer picture and is a more flexible tool than fingersticks, but it’s certainly more expensive.

Increasing Healthcare Expenses:

The cost of healthcare itself has been on an upward trajectory for decades. Factors such as the growing aging population, the explosion of chronic diseases like diabetes, obesity and heart disease, and the increasing demand for specialized healthcare services have all led to inflated medical expenses. These mounting costs inevitably trickle down to health insurance premiums, making coverage more expensive for individuals and families.

Administrative Costs and Overhead:

Let’s be clear that a MAJOR factor in the price surge is the cost of administrating insurance plans and hospitals. Insurance companies must navigate a complex regulatory landscape, process claims, and maintain extensive networks of healthcare providers. These administrative expenses, coupled with overhead costs, contribute to the overall price tag of health insurance

The salary of doctors overall have shown modest growth over the past several decades, whereas there has been explosive growth among non-clinical administrators’ salaries.

The salary of doctors overall have shown modest growth over the past several decades, whereas there has been explosive growth among non-clinical administrators’ salaries.

Lack of Transparency and Negotiation Power:

The Hospital Transparency Rule took effect in January 2021, and requires hospitals to publish costs of procedures “In a display of shoppable services in a consumer-friendly format.” The problem? It’s not enforced.

The healthcare industry’s lack of transparency often leaves consumers unaware of the actual costs of medical services. Without the ability to compare prices or negotiate rates, individuals are left vulnerable to inflated expenses.

Regulatory Factors and Policy Changes:

Changes in regulations and policies surrounding healthcare also impact the cost of insurance. Alterations in legislation, such as requirements for specific coverage or modifications to risk pool composition, can influence premiums. Additionally, the uncertainty surrounding policy changes and their potential impact on the insurance market can lead to increased costs.

Addressing the Challenge: Potential Solutions

While the rising cost of health insurance may seem daunting, there are potential solutions that can help mitigate this issue and ensure affordable coverage for all:

1. Increased Transparency: Promoting transparency in healthcare pricing would empower individuals to make informed decisions, fostering competition among providers and driving down costs.

2. Comprehensive Healthcare Reform: Prioritizing a universal system–one set of coverage rules, one method of seeing lab and imaging results–would mitigate wasteful re-testing and significantly reduce administrative costs. For those who still want “private” insurance, there are a number of examples of countries that offer such options over and above the standard healthcare benefits.

3. Embracing Preventive Care: Placing a greater emphasis on preventive care can help reduce the need for expensive treatments and hospitalizations. Moreover, reimbursements to outpatient clinics and for remote patient monitoring should be improved.

4. Enhanced Regulation: Stricter regulations on insurance companies’ administrative costs and overhead could help curb unnecessary expenses and redirect resources toward providing more affordable coverage options.

Conclusion

The escalating cost of health insurance is a complex issue! So we would not expect one sweeping change to correct this national debacle.

Remember, staying informed about the factors impacting health insurance costs and advocating for positive change are crucial steps in building a more sustainable and equitable healthcare system.

Know your elected officials. Vote for the ones that prioritize the health of our communities. Vote out the ones that prioritize the continued fleecing of American citizens.